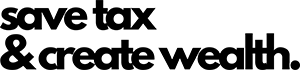

Tax planning is important in financial planning to save tax and to mitigate ones tax burden. We assist taxpayers in deriving tax-efficient plans on their income in a legal approach to reduce the tax burden through tax benefits, deductions, and exemptions and help them to accumulate savings.

Short range tax planning: This plan is executed at the end of the fiscal year

Long range tax planning: This plan is happening at the beginning of the fiscal and the taxpayer follows this plan throughout the year.

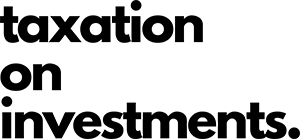

Purposive tax planning: applying the right tax provisions with the purpose of getting the maximum benefit by making suitable considerations for the replacement of assets, diversifying business activities and income, varying the residential status, and correct selection of investment, etc

Permissive tax planning: This method involves planning under various provisions of the Indian taxation laws. Tax planning in India offers several provisions such as deductions, exemptions, contributions, and incentives.